Purse strings set to loosen in 2011 (07/3)

07/03/2011 - 28 Lượt xem

In order to better understand spending trends in Vietnam, the population as a whole cannot be lumped together. Instead, it must be segmented into three categories, rich vs. poor, urban vs. rural and young vs. mature. This will truly show that Vietnam has come a long way in the past 15 years in terms of new segments and their differentiating needs and desires.

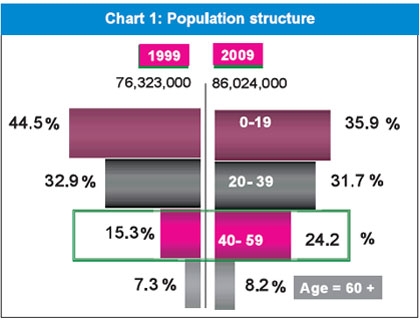

Due to the positive impact of Vietnam’s family planning programme, as well as raising awareness of the population’s responsibility towards children, Vietnam’s population only grew by 10 million from 1999 to 2009. Notably, those aged 40-59 (considered as matured consumers) have become a relatively important proportion, comprising over 24 per cent.

|

|

Vietnam’s population is becoming more mature and the fast development of the retail market in an open economic environment has sped up the maturation and sophistication of this consumer segment.

However, Vietnam’s population is still very young. According to the recent population census, some 30 million Vietnamese are aged 19 and below comprising 35 per cent of the population.

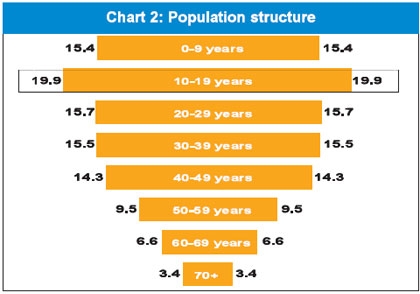

As can be seen in charts 3 and 4, 19.9 per cent of the population today is aged 10-19, meaning that over the next 10 years a staggering 17 million young Vietnamese will be entering the consumer market. These Vietnamese kids are growing up with MTV, internet and much higher expectations and are slowly beginning to adopt a different value system from previous generations. These young and switched on consumers will have very different tastes, needs and desires, which opens up a brand new opportunity for marketers and retailers throughout Vietnam.

|

|

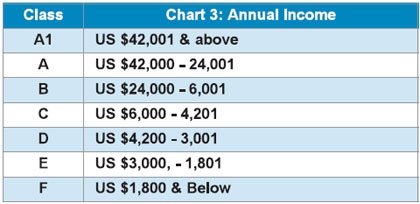

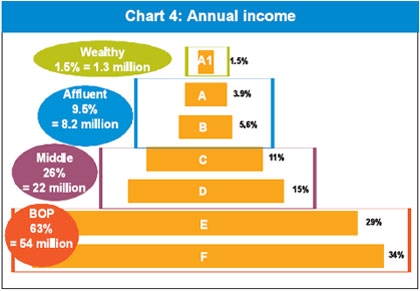

Rich vs. poor

As modeled in the income pyramid (Chart 3), two-thirds of Vietnam’s population is comprised of low income groups (less than $3,000 per year) and these households are still grappling with the basic needs of consumerism. Moreover, the impact of inflation (11.7 per cent) in 2010 and the devaluation of the dong will continue to eat into the purchasing power of these consumers. However, these consumers are also being influenced by mass media and the growth of wealth and also wish to gain consumer inclusion. Hence, affording inspirational products and services for this huge segment of Vietnam is truly a mega opportunity and will be a consumer trend for years to come.

Roughly 1.5 per cent of Vietnam’s population, equivalent to 1.3 million, can afford to live the high life. According to our survey, the members of this group often use high class services, luxury goods and of course travel overseas. They are as affluent as in the western world.

Urban vs. rural

The income levels vary widely between rural and urban Vietnam. In total, 1.3 million rich people, 77 per cent (equivalent to about one million people) are living in the big cities (Hanoi, Ho Chi Minh City, Haiphong, Danang and Can Tho). Inversely, about 7.2 million poor live in urban areas, while nearly 47 million exist in rural settings. Thus, for every 100 rural consumers, 80 belong to low-income groups. This is noteworthy for manufacturers to make goods for distribution in rural areas.

Durable ownership

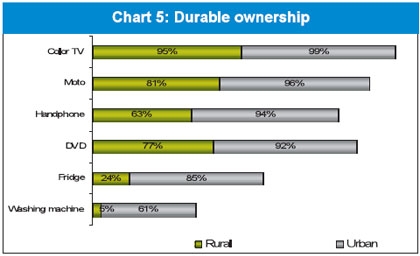

The difference in income between rural and urban areas also makes a difference in the level of durable ownership (Chart 5).

|

Items that are considered necessary for Vietnamese such as vehicles (motorcycles) and entertainment tools (color television) reported a very high ownership level in both areas. Besides, due to the high demand of communications, the development of the media industry and especially the price wars amongst mobile phone producers and service providers, the percentage of mobile phone ownership is relatively high in urban (94 per cent) and rural (63 per cent) areas.

Those living in urban areas have higher income levels, so they pay more attention to their family lives - this reflects in the ownership of products that provide convenience and creature features such as washing machines (61 per cent) and refrigerators (85 per cent). The lower ownership rate of these products in rural areas is easily explained by the lower incomes. Twenty-four per cent of respondents in rural areas said they owned refrigerators, suggesting that their incomes were positively changing.

Ownership of other creature feature products also differed by urban/rural areas, such as air conditioners - urban (32 per cent), rural (1 per cent), microwaves - urban (22 per cent), rural (1 per cent) and cars - urban (1 per cent), rural (0.2 per cent).

2011 consumer confidence

Vietnam’s economy in 2010 underwent a difficult period with high inflation, trade deficits and currency devaluation. However, the gross domestic product still grew by 6.78 per cent.

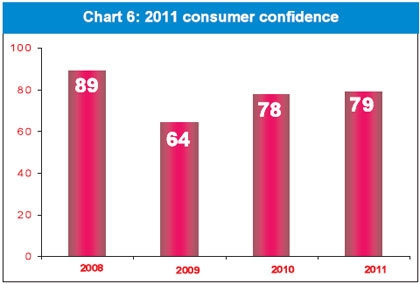

Based on TNS Vietnam’s 2011 Consumer Confidence Poll (Hanoi/Ho Chi Minh City 1,000) the consumer confidence index rose slightly from 78 to 79 for 2011 (Chart 6). Though not significant in consumer confidence upswing, it does show that consumer confidence has stabilised and should mean a slight increase in overall consumer spending.

|

The Vietnamese consumer is one of the most optimistic in the world. In 2009, due to the influence of world economic crisis, the index of consumer confidence fell to 64. However, confidence was quickly restored in 2010 (78) with the rationale that the world economy and Vietnam had been undergoing the worst phase of the global economic crisis in 2008. Consumers’ incomes also saw increases compared to the previous year. For 2011, consumer confidence rose slightly, indicating that consumers felt the economy had stabilised and the worst was behind them.

Consumption in Vietnam in general fluctuates annually, but usually in an upward projection, as Vietnam evolves into developed nation status. This trend will continue, especially with mass media playing an increasingly important role in driving consumption, but devaluation and interest rates may well hamper consumer spending in 2011.

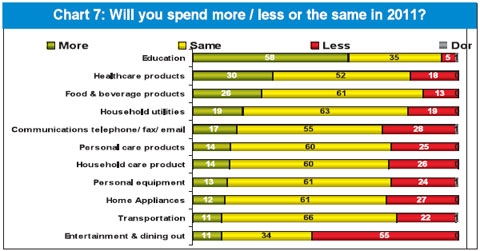

For 2011, Vietnam’s consumption market reports a stagnant growth trend in terms of spending, with only three of 11 sectors showing positive growth. However, considering that the previous year showed nine of 11 sectors growing in spending and that most sectors showed the same spending levels as in 2010, 2011 should continue to see growth, especially in education, food and beverages and healthcare products.

Education as a panacea

Families in major cities are spending more for their children to study in developed countries. According to the Japan Student Support Organisation (JASSO), there are 3,597 Vietnamese students studying in Japan, an increase of 12.4 per cent compared to 2009. The Institute of International Education (IIE) indicated that the number of Vietnamese students studying at universities and colleges in the United States in 2009-2010 increased slightly from 12,823 to 13,112, equal to 2.3 per cent.

In addition, spending in the food and beverage sector experienced over 21 per cent growth in 2010 from 2009, even with inflation at 11 per cent, organic growth was still 10 per cent, the highest in Asia.

The only real loser appears to be entertainment and dining out, where the trend leans more towards eating and entertaining oneself at home and less about frivolous spending on fast food or going to the cinema. However, some entertainers and eateries, such as KFC and Mega Star Cinema, are reporting record growth, as they have been able to attract consumers by investing in understanding consumer needs and hence providing their customers with the right mix between their offers at a reasonable price and the services they provide.

Spending priorities

When asking consumers what products they really wish to buy, it becomes clear that aspirations, convenience, transport and communications are the key trends which will drive consumer spending in 2011 (Chart 7).

|

For the most desired items (not owned), consumers in Hanoi and Ho Chi Minh City showed different expectations. According to a study by TNS Vietnam, the percentage of consumers in Hanoi wanting to own a car, an air conditioner and an LCD/Plasma TV was much higher than that of Ho Chi Minh City.

This indicated that consumers in Hanoi seemed to focus more on appearance and status than consumers in Ho Chi Minh City. Twenty-five per cent of consumers in Hanoi wanted to own laptops, while this rate in Ho Chi Minh City was 14 per cent.

The global economic recession has indeed had an impact on consumer spending and consumer trends in Vietnam. Vietnamese consumers today are more cautious about spending their devalued, inflation-ravaged dong and hence are saving more.

2011 forecast

However, Vietnamese consumers are also feeling more secure about the economy and their lot, and having saved more for the past two years, it is anticipated that Vietnamese purse strings will loosen in 2011. Spending patterns, though not as frivolous as pre-2008 economic boon periods, will see an increase this year.

Source: VIR.