Bright signs amid a dark picture (13/9)

13/09/2011 - 27 Lượt xem

Vietnam has overcome the most difficult period in getting its economy back on track.

The USD/VND exchange rate has become stable and fluctuated around the State Bank’s basic rate. The free market rate slipped from VND22,500 per dollar in early 2011 to VND20,600 in June. Increasing forex reserves are a positive signal. In the first quarter, forex reserves equalled to 3.5 weeks of imports, but climbed to five weeks of imports in June and in August it reached $15-16 billion. In the context of an unstable economy, the increased forex reserves implied high international economic liquidity capacity.

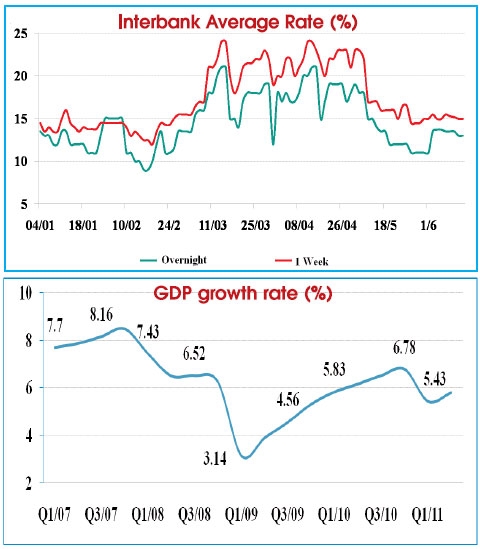

Moreover, deposit and lending interest rates are decreasing. The banking system’s liquidity has improved and become stable. It is forecast that lending rates will continue to reduce towards the year’s end. However, interest rates will still remain high.

The money supply M2 grew very slowly at 3 per cent in the first six months this year, reaching VND78 trillion ($3.74 billion), in which a half found its way into government bonds.

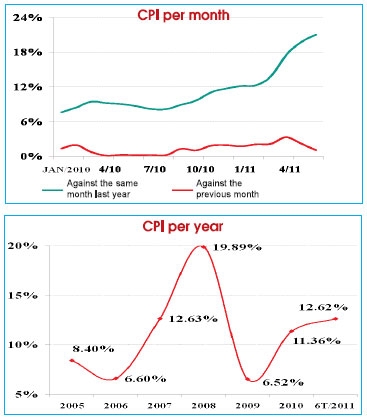

Expected inflation is still high, up to more than 20 per cent, per year. Meanwhile, the world’s economy has become more uncertain in a few recent weeks. Therefore, banks have been exercising caution in reducing interest rates as they may kiss depositors goodbye. The banking system liquidity is stable but has yet to be firm.

Another factor affecting interest rates is that public spending has not been reduced sharply. The state budget deficit in the first six months of 2011 decreased from 5.6 per cent to 5.1 per cent of gross domestic product (GDP) while total development investment fell from 41 to 38 per cent of GDP. Investment from state-owned economic groups and corporations was cut by VND39 trillion ($1.87 billion) during the period.

Forecasted risks until the year’s end

The first issue is the economic growth risk. If the M2 growth rate stayed at 3 per cent, GDP of the third-fourth quarters this year or even the first quarter next year could reach just 4 per cent. Deposits from enterprises which circulate faster than deposits from individuals were nearly exhausted, leading to capital shortages. Meanwhile, lending rates are still high, meaning enterprises produce less, leading to goods shortages, rising prices and inflation.

The second issue is credit risks. Dong credit demand decreased, with less borrowers, excess liquidity and banks rushing to buy government bonds at 12 per cent, per year to disburse temporary surplus capital. Some commercial banks with temporary surplus credit tried to buy corporate bonds, mainly real estate bonds which imply high potential credit risks.

As of the end of June, lending for non-production areas of some small-scaled commercial banks reached 30-40 per cent of total outstanding loans. These commercial banks avoided breaking the 20 per cent credit growth limit by selling debt to other banks.

Therefore, the statistical credit growth of 7.6 per cent in the first eight months of the year may be lower than the real figure. Consequently, banking system bad debt would rise from 2.19 per cent in 2010 to 2.9 per cent at the end of this year.

However, in my opinion, bad debt is not a very serious problem as the asset growth rate is higher than debt growth rate. The biggest issue are acute exchange rate risks. The trade deficit is still high and foreign direct investment (FDI) has decreased slightly. In the first half of this year, FDI disbursement was $3.3 billion, down $100 million against the same period last year. Foreign indirect investment (FII) reduced sharply from $1.79 billion to $350 million.

The total trade deficit for January to August was estimated at $6.2 billion, or 10.2 per cent of total export turnover. It is forecasted that the trade deficit of 2011 will be $9-10 billion, much lower than last year’s $14-15 billion, making positive $4-5 billion balance of payments.

One main factor leading to exchange rate risks is the unreal forex supply, but real demand. As of the end of August, dollar and dong credit growth reached 27 and 4 per cent, respectively.

The large gap between dong and US dollar mobilisation rates made customers opt to deposit in dong for higher interest rates. That induced a huge difference between dollar lending and mobilisation amounts of VND150 trillion ($7.3 billion) in the first six months of the year. Specifically, total mobilisation reached VND460 trillion ($22.08 million) while total lending was VND610 trillion ($29.28 million) during the period.

Reducing interest rate measures

On August 26, the State Bank held a meeting with 12 major banks (G12) to get ideas about future measures. I agreed with new Governor Nguyen Van Binh that before issuing any policy, the State Bank should canvass related agencies’ opinions, including G12 which account for an 86 per cent market share of the whole banking system. This is a logical and practical way to solve any problem.

The State Bank recently omitted the loans-to-deposit limitation of 80 per cent under Circular 19/2010/TT-NHNN for commercial banks. The 14 per cent cap on deposit interest rate will be removed later. This cap, however, will be kept until the year’s end as this time is not suitable for removing it.

Source: VIR.